The banking industry operates in a highly regulated environment, with reporting requirements being a crucial aspect of maintaining transparency and ensuring stability. However, traditional reporting processes often involve preparing and submitting data manually, which can be time-consuming, error-prone, and inefficient. Recognizing the need for digital transformation in reporting, the Bangko Sentral ng Pilipinas (BSP) has introduced a groundbreaking regulation that mandates API-based submission of prudential reports for all regulated entities. This regulation aims to revolutionize the way banks report their financial data, streamlining processes, improving accuracy, and driving regulatory compliance.

In this article, we will delve into the details of this regulation, explore the challenges it presents for banks, and highlight how solutions like Fintellix’s regulatory reporting platform can help overcome these obstacles and maximize the benefits of API-based submission.

The Regulation

The new regulation, which was initially issued by the BSP in October 2021, requires all regulated entities to submit their prudential reports in XML format through an API. This represents a significant departure from the current Excel-based submission to the FI portal and introduces a standardized approach to data submission.

The recently issued memorandum detailed the procedural overview, minimum technical requirements to be ensured by the financial organizations, high-level skill set requirements, and the list of prudential reports in scope for this program, along with the timelines.

As per the new regulation, all the BSP-supervised financial institutions will have to shift from the current excel based template reporting to XML format-based reporting via API. The key tasks of API based submissions transformation program include:

- Move from Excel template-based reporting to XML format-based reporting

- Fully migrate to API-based report submission

- Submission of reports with a Digital Identity of the sender

- Implementation of intra-report level validation and inter-report validation rules

The list of reports included in the API-based submission is below.

- Financial Reporting Package (FRP)

- Basel 1.5 Capital Adequacy Ratio (CAR) Report (for stand-alone TBs and RCBs)

- Basel III Capital Adequacy Report

- Basel III Leverage Ratio (BLR) Report

- Basel III Liquidity Coverage Ratio (LCR) Report

- Basel III Report on Net Stable Funding Ratio (NSFR)

- Expanded Report on Real Estate Exposures

- Financial Reporting Package for Trust Institutions (FRPTI)

- Income Statement on Retail Microfinance Operations (MIS) and Report on Microfinance Products (MBS)

- Minimum Liquidity Ratio (MLR) for stand-alone TBs, RCBs, and NBQBs

- Published Balance Sheet (PBS)

- Report of Selected Branch Accounts (BRANCH)

- Report on Compliance with Mandatory Credit Allocation Required Under RA 6977 (as Amended by RA Nos. 8289 and 9501) (MSME)

- Report on Cross-Border Financial Positions (RCBP)

- Report on Electronic Money Transactions (applicable to Electronic Money Issuers) (E-Money)

- Report on Project Finance Exposures (RPFE)

- Report on Repurchase Agreements of Banks/ Quasi-Banks (REPO Report)

- Stress Testing Reports Covering Credit and Market Risks (STRESS TEST)

The new regulation applies to all regulated entities, including commercial and universal banks, thrift banks, digital banks, and rural banks. The BSP has set up a phase-wise timeline with 30th June 2023 as the deadline to go live with the implementation of the new reporting system.

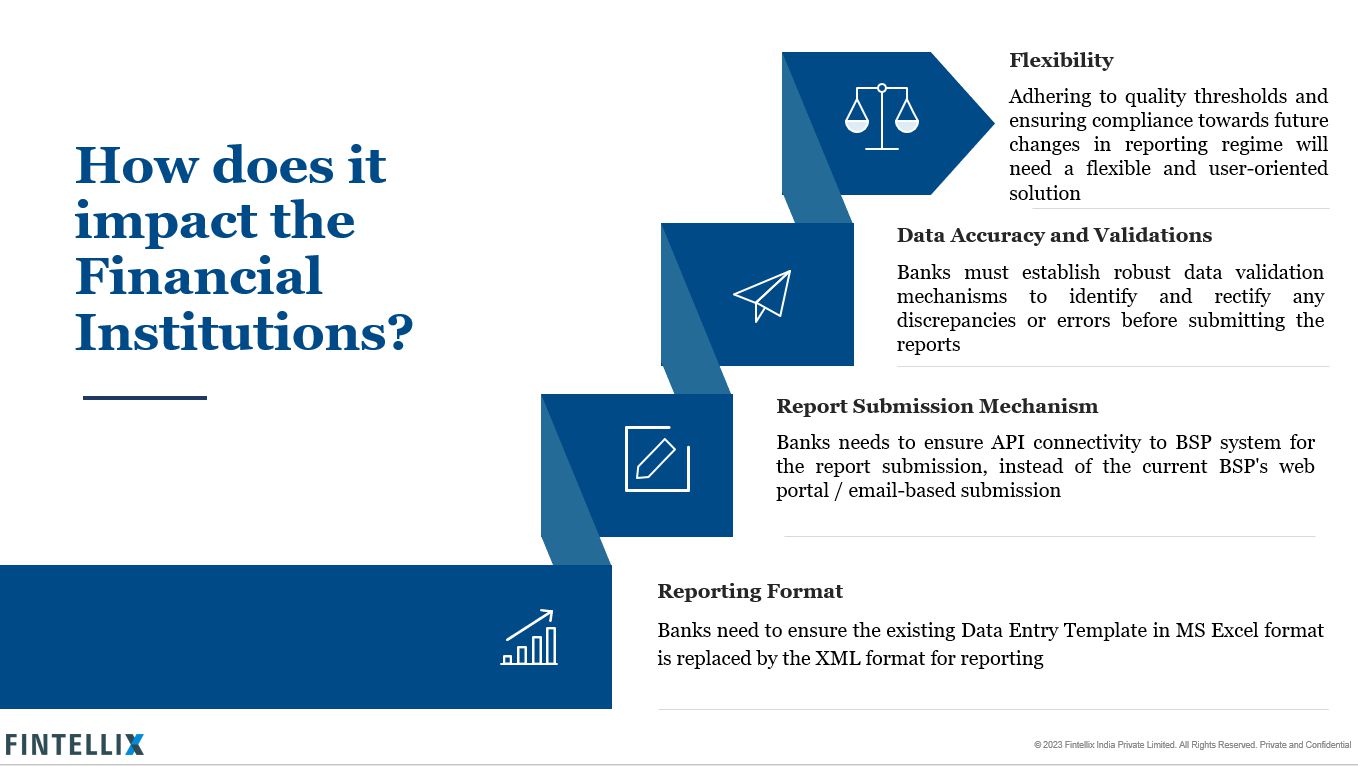

How does it impact the Financial Institutions?

Flexibility: Adhering to quality thresholds and ensuring compliance with future changes in the reporting regime will need a flexible and user-oriented solution. The banks would require a strategic regulatory reporting platform that can easily adapt to the future changes proposed by BSP.

Data Integrity and Validation: Banks must establish robust data validation mechanisms to identify and rectify any discrepancies or errors before submitting the reports. Failure to address these issues can lead to non-compliance and potential penalties.

Report Submission Mechanism: Banks need to ensure API connectivity to the BSP system for the report submission, instead of the current BSP’s web portal / email-based submission.

Reporting Format: Banks need to ensure the existing Data Entry Template in MS Excel format is replaced by the XML format for reporting.

Overcoming the Challenges

The new regulation poses several challenges for the banks, including the need to invest in technology infrastructure, ensure data accuracy and completeness train staff on API-based reporting. Failure to comply with the regulation can result in penalties and reputational damage.

One of the main challenges faced by banks is the need to invest in technology infrastructure to support API-based reporting. Banks will need to ensure that they have a dedicated regulatory reporting system in place which are capable of generating the required reports in the required formats and the ability to submit the report directly from the reporting system to the BSP.

The reporting system should be flexible to accommodate any future changes with less turnaround time and cost, in a non-disruptive manner. The system should support customizable workflows and a user management module to maintain the audit trail of data.

Ensuring data accuracy and completeness is also a challenge for banks. The reporting system should have a robust data validation mechanism in place to ensure that all mandated validations are performed before submitting to the regulator.

Leveraging Fintellix’s Regulatory Reporting Platform

To navigate the challenges posed by API-based submission and maximize the benefits of this new regulatory framework, banks can turn to innovative solutions like Fintellix’s regulatory reporting

platform. At Fintellix, we recommend two phases approach to meet the BSP’s current and future regulatory requirements.

Phase 1 – Last-Mile Reporting Approach

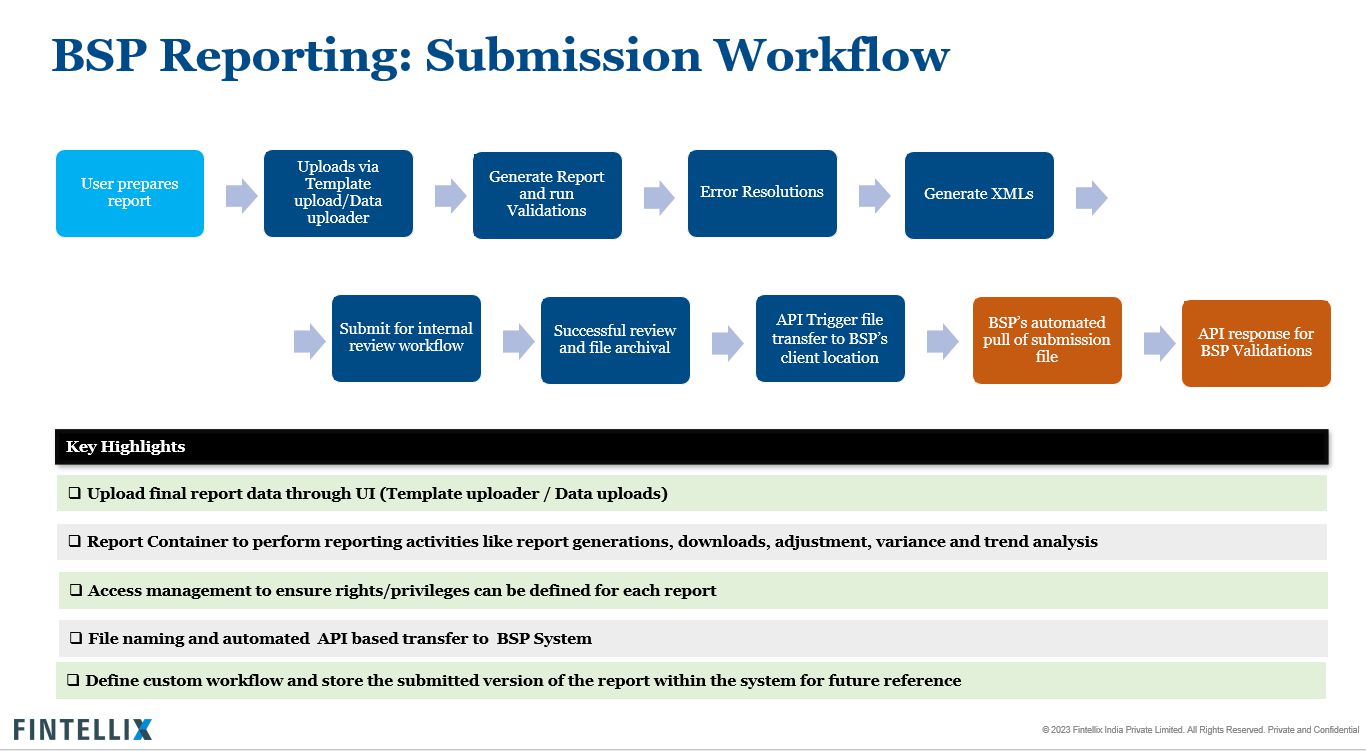

The Last-Mile Reporting (LMR) approach is the tactical approach formulated to achieve the immediate milestones published by BSP.

In this approach, the banks can utilize the Fintellix Regulatory Platform to upload the prepared final numbers to the corresponding report templates and generate the report on the application. Further, the platform can be used for running the validations, resolution of errors, passing any adjustments, generating the report in XML format, and submitting it into the workflows for the approval process. Once the report is approved, it can be directly submitted to the BSP system from the platform.

Phase 2 – Full Automation Approach

Regulators across the world are moving towards consistent reporting standards where they are harmonizing the business definitions for regulatory reporting across the reports. Taking cues from global reporting standards, BSP has introduced this significant change towards automation and standardized reporting mechanism. We believe this is one of the many changes expected by BSP to transform the way the regulator collects and analyzes data for financial supervision and maintain financial stability in the region. Therefore, it becomes imperative for the banks to be prepared for such future regulatory changes through a full automation approach.

In this approach, while utilizing all the functionalities of Phase 1, the banks can automate the entire process of reporting from the source systems till submission to the regulator. In this approach, the banks can leverage the Fintellix Banking Data Model to cover all the different subject areas required for reporting purposes. Our “platform-ised” approach towards reporting makes the solution low code with a focus on end-user enablement and can be configured / re-configured based on newer reporting requirements, making ongoing change management an extremely user-friendly activity. Fintellix Regulatory Reporting Solution covers a host of functionalities like User Management, Workflow Management, Drilldown, Workflows, Data Analytics, Impact Analysis, etc. to streamline the reporting process, improve data accuracy, and achieve regulatory compliance efficiently.

One step ahead along with the full automation, there is a need to tackle the critical gaps in data in terms of data quality, data ownership and data governance. This is where Fintellix data curation platform helps the enterprises to address such gaps in the enterprise data management framework. The platform is designed to help enterprises effectively manage and govern their data assets, empowering the business users to be the gatekeepers with clear ownership and accountability for data completeness, accuracy & timeliness, supported with necessary effective functions and automation, which is crucial to consolidated API-based submission of prudential reports.

Conclusion

The BSP’s new regulation on API-based submission of prudential reports poses several challenges for the banks but also offers several benefits including faster and more accurate reporting, improved regulatory compliance, and enhanced data analytics capabilities. Banks should utilize this as an opportunity to invest in technological solutions which can be leveraged from a long-term perspective while meeting current and future requirements. By leveraging regulatory reporting platforms like Fintellix’s BSP solution, banks can overcome the challenges and reap the benefits of faster, more accurate, and more streamlined reporting processes.