If you work in the Indian banking sector, you’ve probably heard the term Element-Based Reporting (EBR) being whispered in meetings, debated in compliance calls, and featured in RBI updates. It’s not just another acronym for reporting. EBR represents one of the most significant changes in the way banks report to the regulator — and it’s coming sooner than you think.

The shift to EBR is part of a bigger story — a decade-long journey that started with automating reports, moved to centralizing them, and now aims to redefine reporting at its very core. Let’s explore what this means, why it matters, and how banks can prepare for it.

The Road to EBR: A Decade in the Making

Back in 2014, the Reserve Bank of India introduced the Automated Data Flow (ADF) framework. The goal was straightforward: eliminate manual compilation of returns and pull data directly from source systems. It was a huge leap forward for speed and accuracy, but the structure was still return-based — fixed templates with little reusability.

Then came 2021 and the Centralized Information Management System (CIMS). This was RBI’s attempt to unify and standardize data intake. With centralized architecture, more granular inputs, and cross-return validations, CIMS improved consistency — but it still worked within the same fundamental model of “submit a return in this format.”

Now, in 2025, EBR changes the game entirely. Instead of thinking in terms of returns, we start thinking in terms of data elements. These elements are tagged with dimensions, enriched with metadata, and reused across multiple returns. In other words, the RBI is no longer asking you for a form — it’s asking you for the facts, and it will assemble them into the forms it needs.

What Makes EBR Different?

At first glance, EBR might look like just a new way to format data. It’s not. It’s a data-first approach to compliance.

In EBR:

- Every reported figure is an Element — a defined business concept like “Loans & Advances” or “Deposits.”

- Each element is broken down using Dimensions — for example, area of operation (domestic/overseas) or asset quality (performing/NPA).

- Combine an element with its specific dimensions and you get a Data Model Identifier (DMID) — a unique code representing one exact data point. Think of a DMID as a cell in a report.

Why does this matter? Because once you define an element and its dimensions, you can reuse it across multiple returns without duplication. Currently, the same information can be asked for in multiple returns. EBR avoids reporting of same data, thus increasing data consistency.

An Example in Action

Let’s take “Gross Loans and Advances” — a data point reported in ALE as well as RAQ return.

In the old model, you’d fill that number in each return separately. In EBR, that number will be required once in one element, tagged with the right metadata. If it’s needed in multiple returns, the system just references the same element. No copy-paste, no manual alignment, no risk of mismatched values.

It’s like maintaining one master ingredient in a recipe database and using it in multiple dishes — you always know it’s the same, accurate ingredient.

RBI’s Phased Rollout and POCs

EBR isn’t being switched on overnight. RBI is testing it through Proof-of-Concept (POC) exercises with select banks with select returns, such as:

- Asset Liability and Off-Balance Sheet Exposures (ALE)

- Asset Quality (RAQ)

- Liquidity Returns

- Collateral Loan Reports

- Credit to Minority

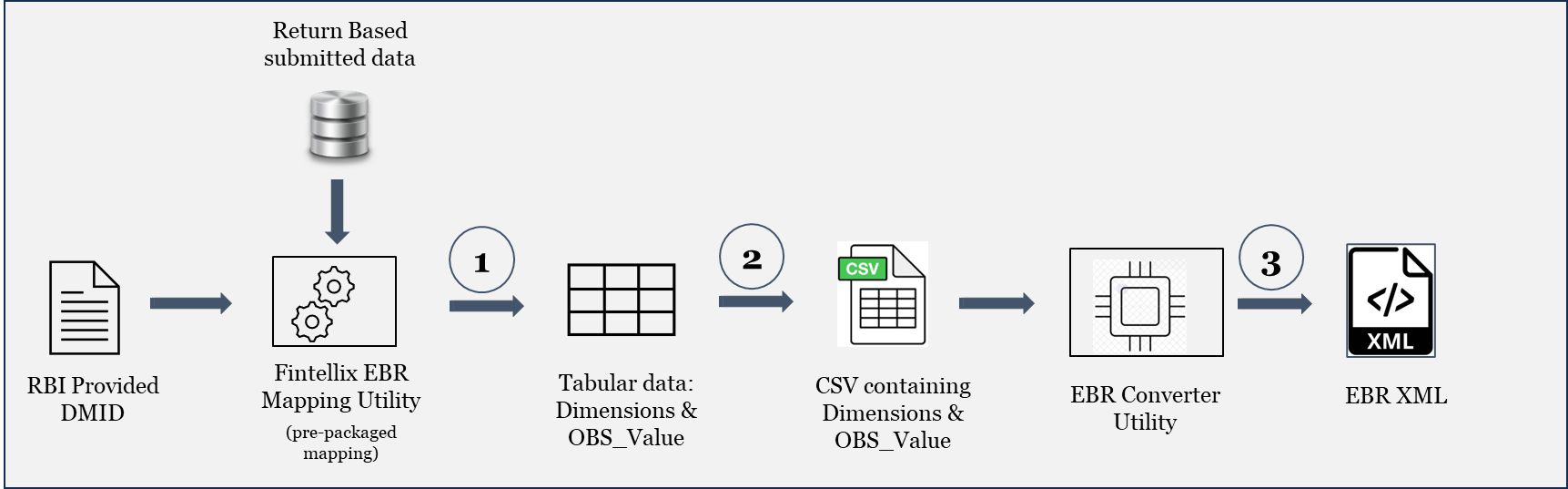

The process works like this:

- RBI provides the Data Structure Definitions for returns.

- The bank maps these to its own data fields.

- The data is converted to a structured table, then into CSV.

- Once we have the reporting table populated in the required structure, the final EBR-XML file can be generated using RBI SDMX utility or a vendor’s conversion tool.

- Finally, the EBR-XML file needs to be uploaded to the CIMS portal of RBI.

This allows banks to test mappings, validate outputs, and get familiar with the process.

What We’ve Learned from POCs

Working with banks on these POCs, a few patterns have emerged:

- Metadata is the foundation: Without a central repository of elements and their attributes, mapping is painful.

- Lineage can’t be an afterthought: Knowing where a data point comes from — system, process, or manual input — is critical for both compliance and troubleshooting.

- Collaboration is non-negotiable: IT, Risk, Finance, and Compliance must work together. EBR doesn’t fit neatly into one department’s job description.

- Data governance is a must: EBR taxonomy contains validations that need to be passed for the successful generation of the EBR-XML file. Expect more validations to be added.

- Start small: Piloting with one or two returns gives teams the experience they need before scaling up.

Challenges on the Road Ahead

Transitioning to EBR isn’t without hurdles, and they fall into three broad categories:

1. Functional Challenges

- Loss of Familiar Formats: Business users are used to structured returns. EBR’s element-DMID model is harder to interpret.

- Dimension Complexity: Understanding open/closed dimensions and managing DMIDs needs upskilling and standardization.

- RBR vs EBR Reconciliation: Banks must reconcile totals between RBR formats and EBR element files during the transition phase.

- Merged Returns into One File: Consolidated XMLs require tighter inter-department coordination for cutoffs and sequencing.

- Preponed Board Meetings: To finalize numbers earlier, some banks are shifting board meeting dates and closing books early.

2. Technical Challenges

- DMID Mapping Complexity: Mappings are not always 1:1 and require logic, not just field matching.

- Element Consolidation: Orchestrating a single XML from 20+ returns is technically complex.

- Version Control of DSDs: Frequent RBI updates to definitions/code lists need metadata-driven solutions.

- Granular Data Readiness: Core systems may lack detailed breakdowns required for new dimensions.

- Parallel Infrastructure: Banks must maintain both RBR and EBR systems, increasing load on IT/OPS.

3. People and Process Challenges

- Role Changes in Reporting Teams: Shift from ‘return preparation’ to ‘data validation and interpretation’.

- Ownership Changes: Return-wise ownership to element-wise ownership

- Cross-Department Collaboration: Finance, Risk, IT, and Ops must collaborate to align element-based data.

- Increased Bandwidth / Effort Need: Significant increase in manual and cross-functional effort during the transition phase—handling reconciliations, managing data transfers, resolving validation failures, and coordinating across functions.

- Training Needs: Staff must understand EBR concepts, SDMX, validations, and submission workflows.

Why EBR is an Opportunity, Not Just a Compliance Burden

It’s easy to see EBR as just “one more RBI mandate,” but forward-thinking banks view it differently. By building their systems around EBR principles, banks can:

- Create a single source of truth for all reporting — regulatory and internal.

- Improve data quality by enforcing standard definitions and dimensions.

- Reduce duplication and reconciliation effort.

- Speed up reporting cycles and respond faster to regulatory changes.

- Enable richer analytics by leveraging granular, reusable data.

Imagine generating your RBI returns, internal MIS reports, and stress-testing dashboards from the same dataset — without worrying about mismatches. That’s the promise of EBR.

How Banks Can Start Preparing Today

Even without a formal go-live date, there are plenty of banks that can do so now:

- Run a readiness assessment: Identify where your metadata, lineage, and systems fall short.

- Build an element repository: Start cataloguing your data elements and mapping them to returns.

- Pilot with a small return set: Learn the mapping and XML conversion process on a limited scale.

- Invest in data management tools: These will be important for DMID mapping and version control, audit trails, etc.

- Train your teams: Business and IT staff both need to understand how EBR works and why it matters.

The Bottom Line

EBR represents a new chapter in India’s regulatory reporting journey — one that aligns with global best practices and pushes banks toward data-driven compliance. Yes, it’s a change. Yes, it requires investment in processes, tools, and training. But for those who start now, the payoff is more than just easier compliance — it’s a stronger, cleaner, and more agile data ecosystem.

The question isn’t whether EBR is coming. It’s about how ready is your bank to embrace it.

Want to explore your bank’s readiness for EBR or see a live EBR conversion demo? Contact us at sales@fintellix.com

About Author

Abhishek Kundan is Associate Vice President & Head of Product at Fintellix Solutions, with over 12 years of experience building customer-centric RegTech products. He holds an MBA from IIM Bangalore and a B.Tech. from IIT Dhanbad. At Fintellix, he leads and manages all products like NPA management, regulatory reporting, and early-warning systems etc. A Certified FRM (GARP), Abhishek combines deep risk expertise with design thinking to drive scalable, technology-enabled solutions. He is passionate about leveraging AI and data analytics to streamline compliance and enhance decision support.