Multicountry RegulatoryReporting

Data Granularity

Data is sourced from upstream systems in as-in manner at the lowest granularity level, which can be transformed to facilitate multiple use cases.

Pre-built Regulatory Reporting taxonomy

Solution is easily configurable to adapt to the specific regulatory needs of any jurisdiction.

Data Lineage

The users can perform drill down actions on any item or field within the reports to see the underlying logic used to calculate the value of that field.

Configurable Mapping Interfaces

Empower business users to manage configurations or reference codes like Industry codes, currency rates, etc. through a simple to use interface.

The regulators have been becoming increasingly dynamic and proactive in strengthening their foothold upon the regulated entities operating in their jurisdictions. The complexity of regulatory changes is evolving quire rapidly, which could vary from introduction of new reports to a complete transition away from template-based reporting to granular data reporting.

In such capricious scenarios, having a reliable regulatory solution provider can be the difference between a seamlessly scalable transition to new norms and an inefficient implementation that leads to high cost of compliance and/or penalties associated with non-compliance.

Fintellix Regulatory Reporting solutions provide a flexible and scalable platform capable of leveraging the existing data infrastructure, while allowing the in-country teams to manage jurisdiction-specific regulatory rules, regulator-driven data validations, and regulatory templates. All of the use cases are built on top of a data augmentation layer through our auditable data management platform. This ensures that the only dependence on IT is for the acquisition of data into an accessible data storage hub, thus increasing the agility and decreasing the cost of compliance.

Features

Excel as a Reporting Tool

Powerful collaboration with document management

Document Collaboration

Powerful collaboration with document managament

XBRL Enabled

Ability to generate reports in XBRL, PDF, XLS and other prescribed regulalrly formats.

Simplified Change Management

Enables business users to manage regulatory changes in a simplified manner, thereby reducing dependency on IT teams

Flexible Data Integration

Seamless integration with any core banking systems/data repository including Global Data Warehouse, Integrate gap data using files in .xls, csv, txt formats.

User Interface

GUI-based utility to manage reference data such as Industry Codes, Branch Codes, etc., Business user friendly interface to maintain regulatory rules and data validation

Features

Excel as a Reporting Tool

Powerful collaboration with document management

Document Collaboration

Powerful collaboration with document managament

XBRL Enabled

Ability to generate reports in XBRL, PDF, XLS and other prescribed regulalrly formats.

Simplified Change Management

Enables business users to manage regulatory changes in a simplified manner, thereby reducing dependency on IT teams

Flexible Data Integration

Seamless integration with any core banking systems/data repository including Global Data Warehouse, Integrate gap data using files in .xls, csv, txt formats.

User Interface

GUI-based utility to manage reference data such as Industry Codes, Branch Codes, etc., Business user friendly interface to maintain regulatory rules and data validation

Benefits

Edit-Check Engine

Embedded Edit-Check engine to create any number of user-defined validation rules.

Data Adjustments

Support for data adjustments to reported fields.

Review Process Flow

Review Process Flow (RPF) engine to easily create unlimited number of user-defined workflows with any number of approval levels.

Audit Trail

System generated log files for Audit Trail.

Metric Scaling

Configurable scaling factor for reporting financial positions and performance as per regulatory or business requirements.

Data Quality

Embedded Data Profiler tool to define and validate against configurable data quality thresholds.

Benefits

Edit-Check Engine

Embedded Edit-Check engine to create any number of user-defined validation rules.

Data Adjustments

Support for data adjustments to reported fields.

Review Process Flow

Review Process Flow (RPF) engine to easily create unlimited number of user-defined workflows with any number of approval levels.

Audit Trail

System generated log files for Audit Trail.

Metric Scaling

Configurable scaling factor for reporting financial positions and performance as per regulatory or business requirements.

Data Quality

Embedded Data Profiler tool to define and validate against configurable data quality thresholds.

Results

Multicountry Regulatory Reporting

- Element Based Reporting

- RBI Reporting

- Risk Based Supervision

- Fraud Analytics

- Compliance Management Solution

- Loan Loss calculation

- ADEPT

- Liquidity reporting

- Philippines

Data lake and analytics | BSP Reporting

- South Korea

FCS Reporting

- Thailand

Data governance and MIS

- Hong Kong

HKMA reporting and GDR

- Singapore

MAS Reporting

- Australia

APRA reporting, and LCR reporting

- United Kingdom

MIS and regulatory reporting, Supervisory platform for insurance

- Saudi Arabia

SAMA Reporting

- UAE

CBUAE Reporting

NPL Management

Early Warning Indicators

ECL Computation

- Mauritius

BoM Reporting

- Kuwait

CBK Reporting, IFRS and Risk solutions

- USA

CECL

Early Alert System

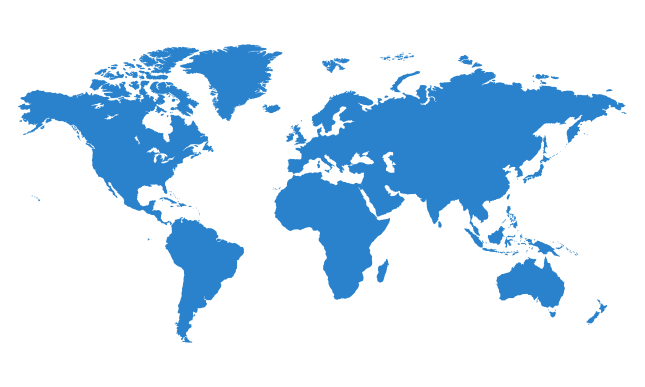

EmpoweringCompliance SolutionsAcross The Globe

Related Videos

(HQ) Bangalore, India

Element Based Reporting, Compliance Management Solution, RBI Reporting, Loan Loss calculation, Risk based supervision, ADEPT,

Fraud Analytics, Liquidity reporting

Philippines

Data lake and analytics | BSP reporting

South Korea

FCS Reporting

Thailand

Data governance and MIS

Hong Kong

HKMA reporting and GDR

Singapore

MAS Reporting

Australia

APRA reporting, and LCR reporting

Kuwait

CBK Reporting, IFRS and Risk solutions

Saudi Arabia

SAMA Reporting

UAE

CBUAE Reporting, NPL Management, Early Warning Indicators, ECL Computation

Mauritius

BoM Reporting

United Kingdom

MIS and regulatory reporting,

Supervisory platform for insurance

USA

CECL, Early Alert System

Mumbai, India

Element Based Reporting, Compliance Management Solution, RBI Reporting, Loan Loss calculation, Risk based supervision, ADEPT,

Fraud Analytics, Liquidity reporting

Automate and streamline your regulatory reporting processes to infuse efficiency, agility, and scalability in your compliance workflows.

Fintellix’s suite of Regulatory Reporting solutions are configurable to cater to the jurisdiction-specific regulations of any regulatory body across the globe in a timely and cost-efficient manner without sacrificing data accuracy.